Deforestation that’s associated with palm oil has fallen by 82% over the past decade in Indonesia, the world’s top producer of the commodity, according to a new analysis.

This is despite a rise in palm oil prices, which historically has been associated with a rise in deforestation as land is cleared for new plantings.

Researchers attribute the continued decline in palm oil deforestation to the rising adoption of zero-deforestation commitments as well as public supply chain reporting by companies.

Mongabay - JAKARTA — Sustainability commitments and greater scrutiny of supply chains are helping bring down deforestation rates associated with palm oil in Indonesia, a new analysis suggests.

The country is the world’s top producer of the commodity, and although production is increasing while prices are rising — factors that usually drive a surge in forest clearing for new plantings — deforestation rates are down significantly, the analysis by palm oil supply chain mapping initiative Trase has found.

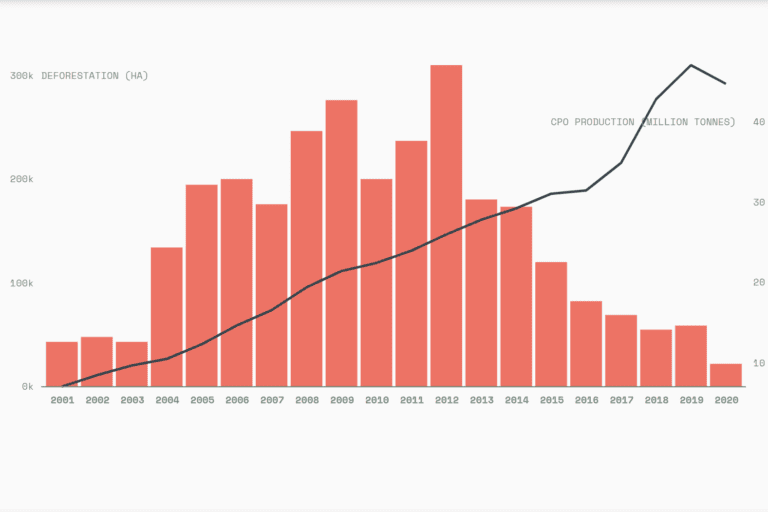

It shows that deforestation for palm oil fell by 82% over the past decade to 45,285 hectares (111,902 acres) annually from 2018-2020, only 18% of its peak from 2008-2012.

Annual area of forests converted to oil palm plantations (thousand hectares, red bars) and annual crude palm oil production (million tonnes, black line) in Indonesia during 2001-2020. Image courtesy of Trase.

Experts attribute this trend to an increasing number of companies adopting no-deforestation commitments, and smaller companies without such commitments simply running out of forest to clear.

“This shows that Indonesia’s palm oil can be developed without deforestation,” said Timer Manurung, director of Indonesian environmental NGO Auriga Nusantara, which was not involved in the analysis. “So no-deforestation palm oil is not something that’s impossible.”

Historically, the link between zero-deforestation commitments and lower deforestation rates hasn’t always been apparent. Indeed, in the first few years after companies adopted zero-deforestation commitments, supply chains bound by such commitments had relatively similar deforestation risk to the broader sector.

“Back in 2018, we didn’t see much evidence that exporters with zero-deforestation commitments were sourcing palm oil with dramatically lower deforestation footprint,” said Robert Heilmayr, an assistant professor of environmental economics at the University of California, Santa Barbara, who led the Trase research.

The analysis found that things have gotten better in recent years, with companies having more fully implemented their commitments and beginning to publicly disclose information about their supply chains.

As a result, exporters with zero-deforestation commitments are now sourcing palm oil from supply chains with lower rates of deforestation for palm oil, Heilmayr said. Similarly, each ton of palm oil exported by traders with zero deforestation commitments had only 70% of the deforestation risk of a comparable ton of palm oil exported by other traders, the analysis shows.

Overall, the supply chain governed by zero-deforestation commitments experienced 45% less deforestation.

“This is a really important result since it represents the first clear evidence of a link between zero-deforestation commitments and lower rates of deforestation on the ground,” Heilmayr said.

Laborers ride a motorbike in an oil palm plantation in Indonesia’s Riau province. Image by Rhett A. Butler/Mongabay.

Room for progress

One way that zero-deforestation commitments are driving greater sustainability in the sector is by encouraging companies to trace back their supply chains and open them up to public scrutiny, Heilmayr said.

The analysis found that palm oil refineries with traceability reports, which processed 87% of Indonesia’s refined palm oil exports in 2018-2020, are associated with lower deforestation risk.

“Indonesia has really taken a leadership role in adopting these standards in a way that doesn’t exist in other globally traded deforestation-intensive commodities,” Heilmayr said.

But there’s room for progress, particularly among smaller exporting companies that are growing rapidly, he said.

Heilmayr said some of the largest exporter groups — Wilmar, Sinar Mas, Musim Mas and Royal Golden Eagle — have seen relatively lower deforestation rate in their supply chains. But their combined market share has declined in recent years, from 68% of Indonesia’s total palm oil exports in 2015 to 59% in 2020, as new players establish themselves in the market.

Among the latter are companies like KPN Corp, Astra Agro Lestari and Citra Borneo Indah (CBI), which saw their share of the export market grow from less than 5% in 2018 to more than 10% in 2020.

“And some of these groups have the highest rate of deforestation per hectare,” Heilmayr said.

KPN, Astra Agro and CBI have all adopted zero-deforestation commitments, but each ton of palm oil that they export is 1.7 times as likely to be linked to deforestation as shipments from the bigger companies, the Trase analysis shows. It attributes this to the fact that the smaller companies export mostly to markets with less stringent traceability and sustainability requirements in Asia and Africa.

The same three companies are also the only corporate groups among Indonesia’s top 12 palm oil exporters that didn’t publish a traceability report in 2020.

“So lack of traceability might be why these groups have seen higher deforestation,” Heilmayr said.

Deforestation linked to palm oil production has slowed somewhat in recent years. Research by TRACE shows that high volumes of palm oil are sourced indirectly, potentially increasing the risk of connections to forest loss.

Market disparities

The markets themselves present another opportunity to further tackle deforestation in the palm oil supply chain, the analysis says. Another room for progress is in the market itself, as some of the fastest-growing markets for Indonesia’s palm oil have weaker sustainability standards, less reporting and more deforestation risks.

Indonesia’s top palm oil export markets are China and India, while its domestic market consumes for 40% of its total palm oil production. All three markets also have weaker sustainability standards and fewer reporting requirements than markets such as the European Union or the U.S.

The Trase researchers estimated that a ton of Indonesian palm oil destined for the domestic, Chinese or Indian markets is 2.4 times more likely to be associated with deforestation than an identical volume exported to the EU. In fact, 97% of the palm oil that Indonesia exports to the EU, U.S. and U.K. comes from companies with zero-deforestation commitments, the analysis shows.

However, these markets bought only 9% of Indonesian palm oil in 2020.

Herry Purnomo, a scientist at the Center for International Forestry Research (CIFOR), said there’s simply not enough demand for sustainable palm oil in markets like China and India.

“We know that countries like China, Pakistan and India don’t really care about it,” he told Mongabay, adding it’s a similar situation in the domestic market.

“Domestic buyers are more concerned about whether a product is certified halal or not, rather than whether it’s certified by the RSPO [Roundtable on Sustainable Palm Oil] or the ISPO [Indonesian Sustainable Palm Oil],” he said. “So [the efforts] have to be from both sides, the producers and buyers. Agricultural products are buyer-driven. If the buyers require [sustainability], then the products have to follow [the demand]. If not, they won’t be bought.”

The RSPO is the world’s leading palm oil sustainability certification scheme, while the ISPO is the Indonesian government’s certification scheme, which is mandatory for all palm oil growers in the country.

Deforestation risk remains

Lack of transparency remains a hurdle to bringing down the deforestation risk in markets like Indonesia, Heilmayr said.

“One challenge that we encounter is we rely a lot on trade data to link back to specific refineries and mills, [and] that is unavailable on the domestic market [in Indonesia],” he said. “So we have relatively little insight on where the domestic market is sourcing its palm oil from.”

In addition, some companies in Indonesia also don’t have traceability reports; if they do, they almost never publish volumes of traded palm oil, Heilmayr added.

“I think if Indonesia and the palm oil sector want to take global leadership in this development in the supply chain transparency, really committing to providing volumetric data about those flows will be the next step to take,” he said.

Another point of concern is that many oil palm concessions that have already been issued to companies still contain large swaths of forest that may be legally cleared, said Timer from Auriga Nusantara.

“Indonesia’s forests are not yet out of danger: 2.4 million hectares [5.9 million acres] of intact forest remain in existing palm oil concessions,” he said. “Legally speaking, companies could clear [these] forests. Right now, there’s no legal protection. What we can do is [to push] companies to have zero-deforestation commitments and [to protect] high-carbon-value and high-carbon-stock forests.”

Maintaining the current gains

With palm oil demand continuing to grow, both in the domestic and global markets, there are concerns that deforestation may yet increase, especially in areas where new palm oil mills are being built.

An analysis by Auriga Nusantara shows that the presence of mills contributes to an increase in deforestation association with palm oil. In the province of Aceh, on the island of Sumatra, the NGO found that 84% of deforestation for palm oil occurred within 20 kilometers (12 miles) of mills.

“Forest-rich areas … will face pressure if production expands, especially if new mills are built in areas with fewer mills today,” Timer said, adding that the forests in Indonesia’s Borneo and Papua regions would be hit especially hard.

Together, these two regions accounted for 77% of all deforestation for palm oil in the country from 2018-2020. The Papua region is at particularly high risk, as palm oil produced there experienced a 24% increase in deforestation risk during a near doubling of production from 2018-2020.

As companies with weaker sustainability commitments increase their market share, and large areas of rainforest still vulnerable to being cleared within existing concessions, there needs to be a greater effort to prevent forests being lost to oil palms, said Helen Bellfield, deputy director of Trase.

“Trase data shows Indonesia making impressive progress,” she said, but noted that similar success in scaling back deforestation in the Brazilian Amazon a decade ago was followed by a surge in destruction.

“The story of Brazil after 2012 warns us that gains in forest protection are fragile, and easily lost,” Bellfield said. “This is the time to intensify both government and private sector efforts, such as strengthening the ISPO standard and stepping up implementation of zero-deforestation commitments, including more detailed traceability reporting.”

Reposted with permission from Mongabay- Original posting by Hans Nicholas Jong on 18 October 2022